2022 tax brackets

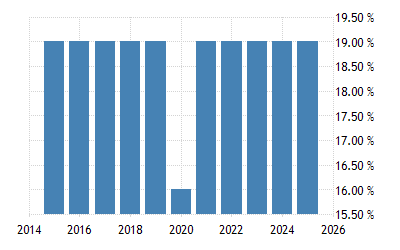

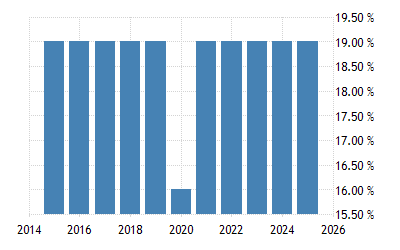

Income Tax rates and bands. The top marginal income tax rate.

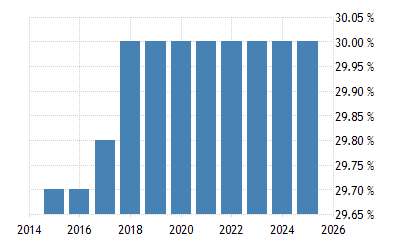

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

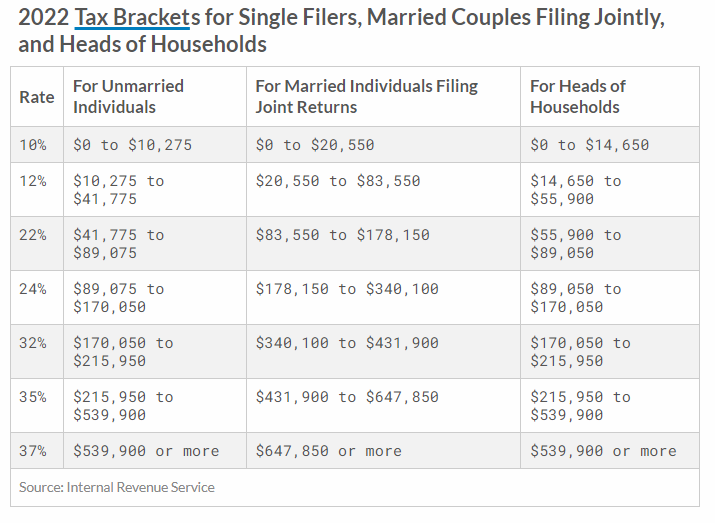

The 2022 and 2021 tax bracket ranges also differ depending on your filing status.

. Your bracket depends on your taxable income and filing status. Up from 20550 in 2022. Here are the new brackets for 2022 depending on your income and filing status.

For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and ends at 89075. Residents These rates apply to individuals who are Australian residents for tax purposes. Taxable income up to 20550 12.

Federal Income Tax Brackets for 2022 Tax Season. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals. The table shows the tax rates you pay in each band if you have a standard Personal Allowance of.

Single tax rates 2022 AVE. 1 day agoForty-year high inflation has driven up the standard deduction for 2023 as well as the tax brackets earned income tax credit and more. Heres how they apply by filing status.

When it comes to federal income tax rates and brackets the tax rates themselves didnt change from 2021 to 2022. There are seven federal tax brackets for the 2021 tax year. The current tax year is from 6 April 2022 to 5 April 2023.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. It is taxed at 10 which means the first 9950 of the. Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for.

These are the rates for. 20 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. Heres a breakdown of last years income.

32 for incomes over 170050 340100 for married couples filing jointly. To access your tax forms please log in to My accounts General information Help with your tax forms Fund tax data 2022 tax. There are still seven tax rates in effect for the 2022 tax year.

Resident tax rates 202223 The above rates do not include the Medicare levy of 2. 24 for incomes over. 17 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430.

10 12 22 24 32 35 and 37. There are seven federal income tax rates in 2022. Below you will find the 2022 tax rates and income brackets.

This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax rates was due in April 2022. 16 hours ago2022 tax brackets for individuals Individual rates. 1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140.

The lowest tax bracket or the lowest income level is 0 to 9950. Each of the tax brackets income ranges jumped about 7 from last years numbers. Remember these arent the amounts you file for your tax return but rather the amount of tax youre going to pay starting January 1 2022.

The IRS has set seven tax brackets 2022 taxpayers will fall into. Federal income tax brackets were last changed one year ago for tax year 2021 and the tax rates were previously changed in 2018. Here are the 2022 Federal tax brackets.

2022 Tax Bracket and Tax Rates There are seven tax rates in 2022. For married individuals filing jointly. 35 for incomes over 215950 431900 for married couples filing jointly.

10 12 22 24 32 35 and 37. A tax bracket is a range of incomes subject to a certain tax rate which is determined by your filing status and taxable.

Germany Sales Tax Rate Vat 2022 Data 2023 Forecast 2000 2021 Historical

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

Analyzing Biden S New American Families Plan Tax Proposal

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Ato Tax Time 2022 Resources Now Available Taxbanter

Germany Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

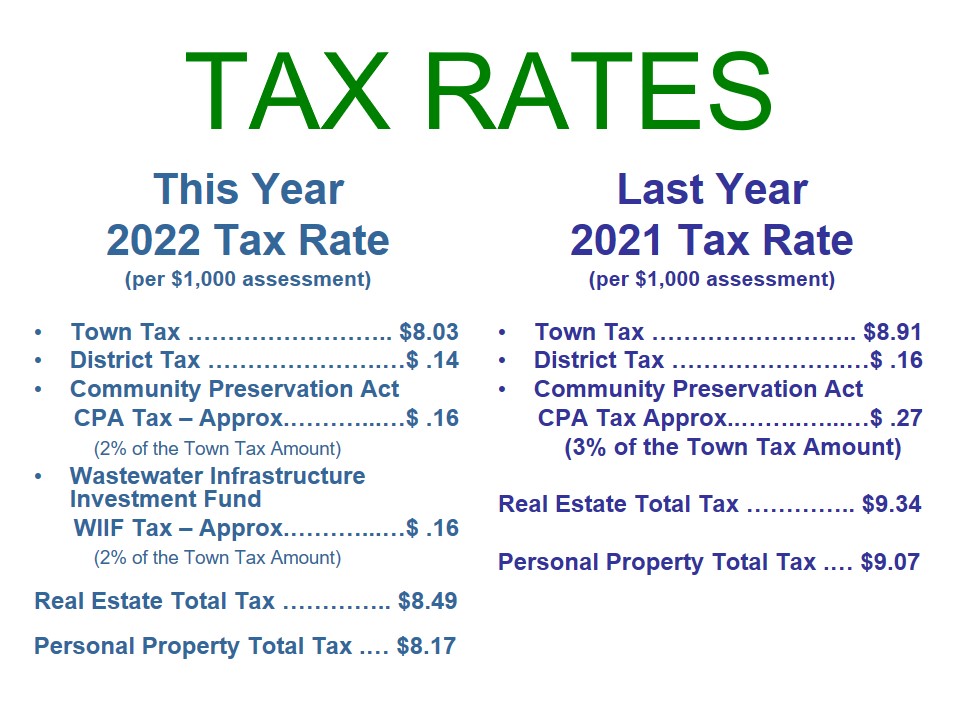

Fiscal Year 2022 Tax Rate Town Of Mashpee Ma

Budget Highlights For 2021 22 Nexia Sab T

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Twitter এ Tax Foundation 2022 Tax Brackets Https T Co Ppudrxlsoq Https T Co Fqaga4odlw ট ইট র

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

Tax Rate Changes Starting Now Initiative Chartered Accountants Financial Advisers

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

2021 And 2020 Inflation Adjusted Tax Rates And Income Brackets

2022 2023 Tax Brackets Rates For Each Income Level

2022 Tax Brackets Internal Revenue Code Simplified

Nyc Property Tax Rates For 2021 2022 Rosenberg Estis P C